Historically, money has slithered into my somatic garden with its rattles. It’s loud, makes its presence known, and has given me a fear that only my kidney chi would define as depletion.

Pulling me through weeds as tall as the atmosphere would allow.

Dry, brittle, and untamed. Was it me? Or was my relationship with money itself that needed trimming? Snip. Snap. For many years, I attempted to be a financial gardener, or a steward of opulent circulation, but I hid. Oh, hiding kept me so small. The smallness that you inevitably enjoy until you don’t.

Financial weeds have a way of making you feel safe in a very twisted inner child way.

They convince you with the nice thought of getting out one day.

“One day.”

You know that one day of financial inspiration turns into weeks, years, centuries inside one lifetime of avoidance, fear, and self-shame.

I find this piece has parallel timing with the topic of money, life abundance, and energetic prosperity being a theme in June.

In the Northern Hemisphere, this month flickers with sun kisses, sweet bearings of fruit, and an opportunity to become bigger. To take up more space. To live out the inventory you have been quietly collecting from the seasons before.

I want to make a note here that we must find the courage to equate richness outside of numerical data. It is a radical act of rebellion and beauty to proclaim and take ownership of our wealth, being undefined by such mathematical symbolism.

However, I am a woman of curiosity. I have a new goal of not judging those with affluence; right now, I only care to get curious. Inquisitiveness will do more for your expansion than judgment ever could.

I am a feline of fascination when it comes to money, how it’s made, the journey of an earthling generating it. I love to bathe in someone’s transparency. It makes me warm-blooded, not in the way of boiling in bubbles of frustration, but in feeling a zest in my flesh.

Money is still so unutterable (unless it’s about the bondage of scarcity, then we can have heaps of those conversations).

I crave to mumble and utter it in ways that feel open, less bone-shaking, and loving.

Can we create a space where money loves us back?

I believe that’s something to dance with as we elongate our days, touch the hands of friends, and become attuned to the immaculateness of power that is claiming a different type of economy: the richness of true self-care.

Self-care in a high-yield savings account so your money can make money (I’m signing up for my first one this week).

Self-care in peeling back the “I don’t know how” when it comes to investing.

Self-care in making small adjustments to build up that emergency fund.

Recently, I shared in a newsletter (if you’d like to receive that weekly love note outside of Substack, please join here!), about how I opened up on making my biggest sale day in my business thus far: $7k, if you wanted to know.

I felt so fucking cringe.

But I knew that there were women out there who were also like me: making herbal infusions, in touch with the elements, tea enthusiasts, lovers of farmer’s markets, etc., who are also curious.

Curious not in the “scale to $100k months” ads we see on social media that feel colossally ancient at this point, but curious in a way where we hold both truths: prosperity is barbarically limited in just numbers, but also, what are the numbers?

What did you do to create not just safety, but true wealth? What type of accounts have you opened up? Where did you learn that from again?

To be honest, I wasn’t expecting the sheer outpouring of replies to that newsletter. Women, like myself, who were also led by soft curiosity. Women who wouldn’t be buying mega mansions with their millions, but spending more time reading by bodies of water, going on airplane mode, and eating a good cheesecake.

Simple opulence.

That’s what I imagine for myself, and apparently, many of you share that vision as well.

I find that any cringe you have about finances is worth sharing.

So, to continue my cringe financial journey, I wanted to give you an intimate peek at my first-ever financial coaching session. I’m so delighted to share that this was hosted by the phenomenal women behind my new favorite financial resource:

. Lexi & Delana are some of the kindest, most open-hearted people to ever let into your personal finances sphere (especially when you have money heebie-jeebies).If you asked me 5 years ago if I would be willing to do this, I would have ghosted you for a millennia.

Now, I’m writing a Substack about it, hoping you join me in healing through creating internal & external financial well-being too.

I’m far from perfect at anything with finances; I’m messing up, slipping, and sliding along the way. But, I would love to be more open about them so you can feel less alone in this labyrinth. True progression is not done linearly; it is tethered in spirals.

(( a gallery of my simple opulence: time in nature, skincare that makes you feel like a holistic princess, pens for days, a curated stick of Japanese incense, moments with my creature, and a book that requires you to turn off your phone ))

The session began before the session actually began. The women behind Wealthkind sent me what they call an “aligned money tracker” before our call (which again, 5 years ago would have sent me running for the hills. Goodbye! Farewell! Never to be seen again).

It was a pre-calculated spreadsheet that made me come face to face with my income after taxes, spelling out what my fixed expenses are (rent, utilities, dog food, phone bill, etc.). debt repayment, monthly savings/investing, and then flexible spending.

I find that the shadows that live inside the financial weeds in your garden are there simply because you have gotten so used to avoiding them. They have essentially become the garden themselves.

Half the battle (if it feels like a never-ending fight or struggle) is due to not looking at your numbers. Very simple, plain, and eye-rolly all wrapped into one money sandwich. Please take this from me, a healing avoidant queenie who always says no goat cheese.

Just looking at what comes in and what goes out will do more for you than another meditation, money healing course, chakra initiation, etc. I’ve done them ALL for the past decade.

Money has taught me that it’s earth-based. It’s seasonal. Practical. It just wants your embrace for what is presently there. Not what isn’t there or what you wish was there, just was is there now. Sigh, drop your shoulders, love on your money now, no matter the size, weight, or volume. ꩜

Once I made the jump to clicking on that Zoom link, I was greeted by the delicate compassion that honestly only women could provide in such a session, mysterious as “financial coaching” is, I felt safe.

We went through all my numbers (yep, all of them, including my credit card debt, the money left over without a home, and the $0 next to investments).

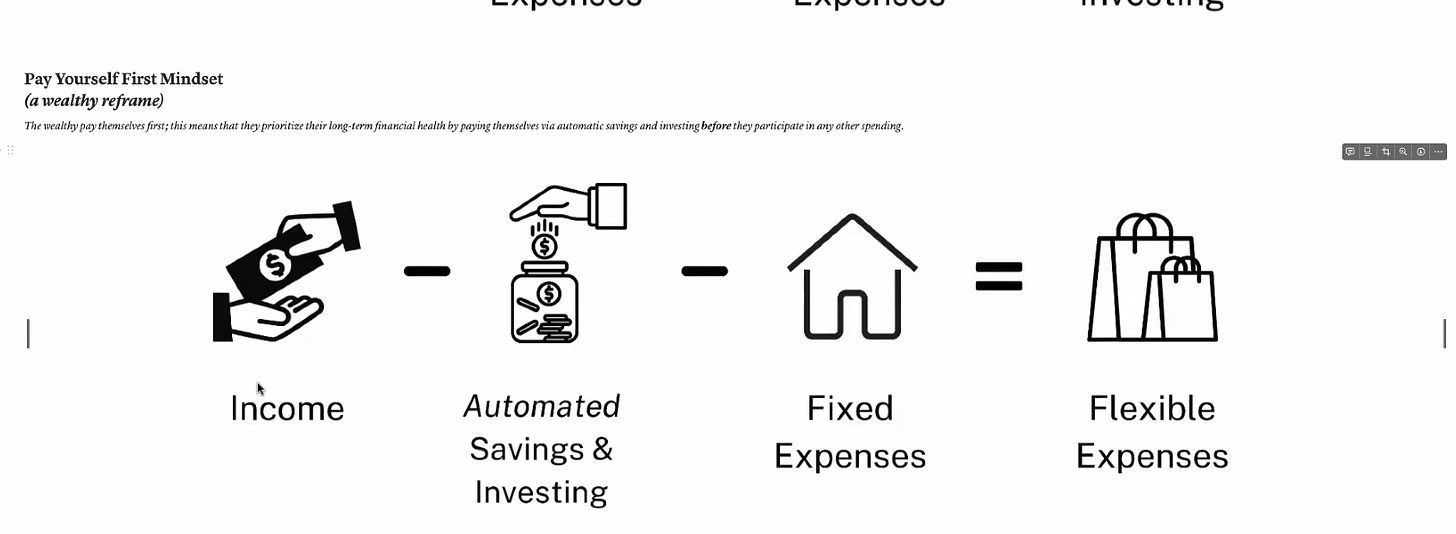

They gave me probably the biggest mindset gift I’ve ever received upon picking up threads of personal finance advice: pay yourself first.

“Wealthy people pay themselves first,” Delana confidently mentioned, which, to my brain, never trickled down as I was passed down this old framework = income - fixed expenses - flexible spending = savings and investing (basically saving whatever is left over from everything else).

The above image is what I screenshotted from our session. It’s the Pay Yourself First Mindset that is completely shame/guilt-proof for when you want to buy that buccal sculpting facial every month.

These women taught me that the word -discipline- should just be replaced with the word automation. It’s not about becoming a personal finance expert in your life, but about setting it all up automatically.

It actually is that simple.

During the session, I had zero automation set up. My emergency fund was all in a checking account that was gaining zada interest compounding daily (money growing money just by being in the account).

I haven’t dipped into investing yet because I’ve felt intimidated to do so, but in all honesty, I’ve just been putting it off, and now I’m more inspired than ever to open my first brokerage account.

The hot tips I received from these personal finance angels:

Tackle down credit card debt right away, especially if your interest rate is above 8%. My current interest rate is 27% (yikessssss). My CC is basically making money off me. Make it a goal to pay double or even triple the minimum amount so you can shed literally years off the amount owed. I like Ramit’s debt payoff calculator to see how long it will take to eliminate this. Lexi recommended that I call my CC company and ask for a payment plan, which actually makes me excited.

You don’t have to deposit thousands of dollars to open your first investing account. Even contributing $10 a month is better than nothing. True wealth isn’t in your checking account; it’s generated through investing.

If you want to invest in something within the next 5 years, keep your cash. If you want to purchase property or something that requires more time, put your cash in the stock market so it can grow.

Ideally, 50-60% of your income goes towards your fixed expenses (they said most women come to them with 80-90% of their income going towards fixed expenses). I think this is the year we drop funkiness over doing little side jobs (or other bigger jobs) in order to become more holistic with our allocations.

Healthy credit card behavior = autopay the entire amount owed every month so you aren’t stacking up interest

Women deserve Venusian pleasures. When you adopt a pay yourself first method, you release activations around the weekly flowers or the pearl ring because you are literally taking care of your retirement, emergencies, etc. Every dollar needs a home; you’re allowed to make that financial abode a beautiful one.

SUBLIMINAL SHIFT COMMUNITY OPPORTUNITY:

I’m excited to announce that

and I will be doing a co-authored Substack on answering your juiciest personal finance questions! 。𖦹°꩜.ೃ࿔By commenting below or DMing me on Instagram here: What do you want to know about personal finance from Lexi & Delana? What spiritual/philosophical meaning do you want on it from me?

This is your opportunity to engage with Substack and make it feel more connected, more prosperous. We would love to get all inquiries possible to make our collab in service of this special corner on the internet. 〰️

When I first got introduced to these financial cool girls, I knew that this collab would be in your hands. I want financial education to be more accessible, healing, and open. I want you to be a part of this more than anything else because, well, it’s for you.

Let me know what your burning personal finance questions are by commenting below. I would love to know xoxo

I love this! Thank you! I’ve begun to adopt the pay yourself first method and truly feel more at peace and in control. I’d love advice on how/where to invest, and curious to hear more about your take on side jobs

ADORE X 1938;63 this post! Over here singing praises for recognising *really truly wholly completely madly deeply* that money is earthy, practical and neutral. It does not need you to sing to it or constantly dig in to your train, FFS. It doesn’t need wealth energetics if it’s not getting eyes on it like you share here. I wish I invested the $30k I paid wealth coaches into the market. lol. Never too late to get moving, which is what I’m on track with now, too. Doing it alongside you